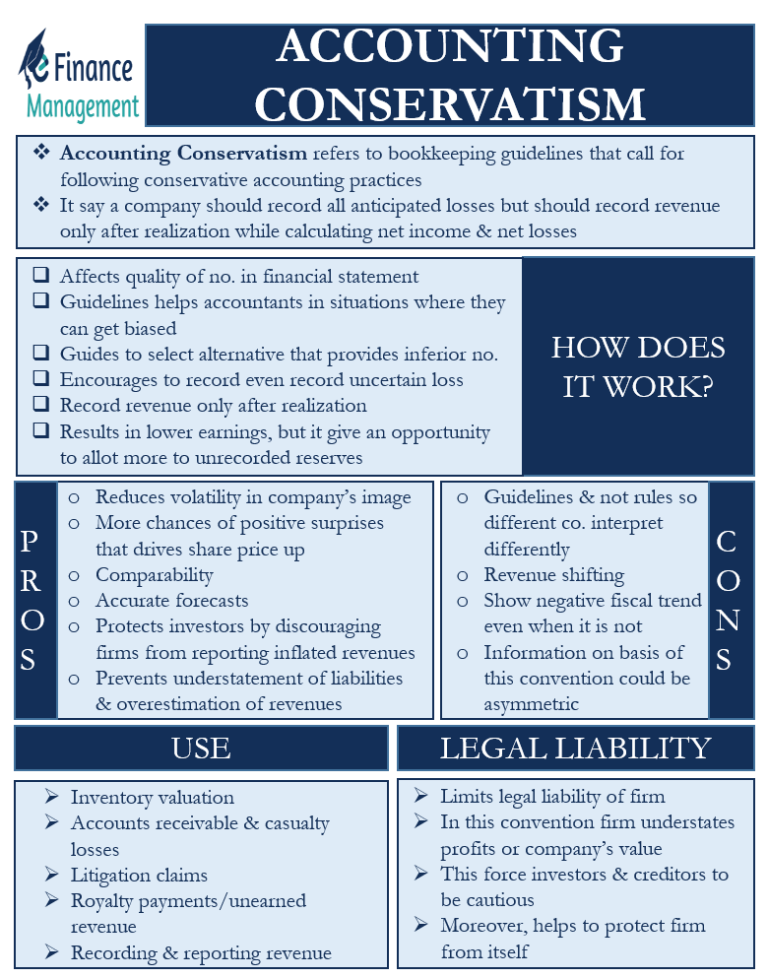

The conservatism principle of accounting states that the accountants must choose the most conservative outcome when two outcomes are available. The main logic behind this principle of conservatism is that when two reasonable possibilities for recording a transaction are available, one must err on the conservative side. It means one has to record uncertain losses while staying away from recording uncertain gains. So when the conservatism principle of accounting is followed, a lower asset amount is recorded on the balance sheet, and lower net income is recorded on the income statement. So, adhering to this principle will record lower profits in the statements.

Disadvantages of conservatism in accounting

Another situation when you might use conservatism accounting is when you’re valuing inventory. Using the conservative method, the lower historical cost would be recorded as monetary value. You’d also use this concept when estimating casualty losses or uncollectable account receivables, along with any time you expect to win gains but don’t yet know the specific amount. Conservatism Principle is a concept in accounting under GAAP that recognizes and records expenses and liabilities- uncertain, as soon as possible but recognizes revenues and assets when they are assured of being received.

How conservatism accounting works

- These doubtful debtors are included in the provision under the prudence concept of accounting.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- The principle of conservatism gives guidance on how to record uncertain events and estimates.

- A classic example is inventory where the net realizable value (NRV) is less than the actual cost.

For example, the entity should recognize the liabilities that claim to the employee for the legal case even the entity not sure if they are failing. Imagine Company A has some accounts receivable (money owed by customers) that total $10,000. However, there is uncertainty about whether all customers will be able to pay their debts due to economic challenges in the industry. This can get done any time that you expect to have gains but you’re not entirely sure what the specific amount will be. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Accounting Conservatism: Definition, Advantages & Disadvantages

The principle of conservatism gives guidance on how to record uncertain events and estimates. The principle of conservatism states that you should always error on the most conservative side of any transaction. Most of the time this means minimizing profits by recording uncertain losses or expenses and not recording uncertain or estimated gains. The purpose and objective of the conservatism principle is to ensure that financial statements provide a fair and conservative presentation of an entity’s financial position and performance, even in the face of uncertainty. Under the conservatism principle, assets and revenue could be recorded or recognized unless it is clear that the entity could measure those transactions reliably. In addition, the expenses and liabilities are records at the highest value where assets and revenues are recorded at the lowest value.

Great! The Financial Professional Will Get Back To You Soon.

This is used as guidance when there’s a need for estimation in accounting, preventing inflated figures or bias. Accounting conservatism is the concept that a business should take the most conservative view to recording business transactions. Doing so reduces the risk that transactions entered into an accounting system will need to be adjusted at a later date. This means that expenses and liabilities are recorded as soon as possible, while revenues and assets are recorded only when there is significant assurance of their receipt. Generally accepted accounting principles (GAAP) insist on a number of accounting conventions being followed to ensure that companies report their financials as accurately as possible. One of these principles, conservatism, requires accountants to show caution, opting for solutions that reflect least favorably on a company’s bottom line in situations of uncertainty.

Conservatism principle is the accounting principle that concern with the reliability of Financial Statements of an entity. The conservatism principle provides guidance to accountants on how to records and recognizes the uncertainty outcome of revenues, expenses, assets, and liabilities in financial statements. Following the conservative approach, companies can only claim profit when it’s fully realized and legally verified. A company should factor in the potential worst-case scenario when making financial forecasts under these guidelines. For example, if there are two options to choose from, the accountant should choose the one with lower numbers to stay on the safe side. While uncertain liabilities would be recorded upon discovery, revenues can only be recorded upon assurance of receipt.

Now, let’s assume that after the date of the balance sheet, the market price of the shares has risen from $14 per share to $17 per share. In reality, a gain of $3 per share has been made, but it is unrealized because the shares have not been sold by the date of the balance sheet. If we buy shares at $14 per share, a record should be added to the balance sheet at cost. Let’s assume that the shares were purchased purely for speculation purposes (i.e., in the hope that their price will rise and we will be able to sell them at a profit). The prudence principle of accounting is essentially the policy of “playing it safe.”

Doing so tanks the reported results in the current period, but creates a large reserve against which management can dump any number of losses in later periods. The outcome is a services of overstated financial statements in later reporting periods. Approaching your financial statements using conservatism accounting ensures that they’re prepared with caution. The aim of this concept is to protect investors from potentially inflated revenues and assets. The main goal of this approach is to show accurate revenues and assets. You’re going to overstate losses and understate the recognition of profits.

These doubtful debtors are included in the provision under the prudence concept of accounting. Following this approach, you can only claim profits once they have been realized and verified. Basically, uncertain liabilities are going to get recorded once they’re discovered. It requires company accounts to be prepared with caution and high degrees of verification. The point is to factor in the worst-case scenario for a company’s financial future.

In the conservatism accounting principle, revenue and expenses both need to be realized. If they’re not realized, you can’t record them on your income statement or balance sheet. If you make a transaction that doesn’t result in a monetary exchange, revenue doesn’t get recognized. So if there is no specific dollar amount exchanged then it doesn’t get recorded. The principle of Conservatism is mostly concerned with the reliability of the financial statements of a business entity.

This leads to an imbalance, with the current period understated and the future period overstated. You have already included the worst possible outcomes and lower estimates. It’s all what is a regressive tax going to depend, as with any GAAP there can be both benefits and disadvantages. And with conservatism accounting, it might seem as though there’s not going to be many benefits.